-

2024年4月14日

この物件のおすすめポイント

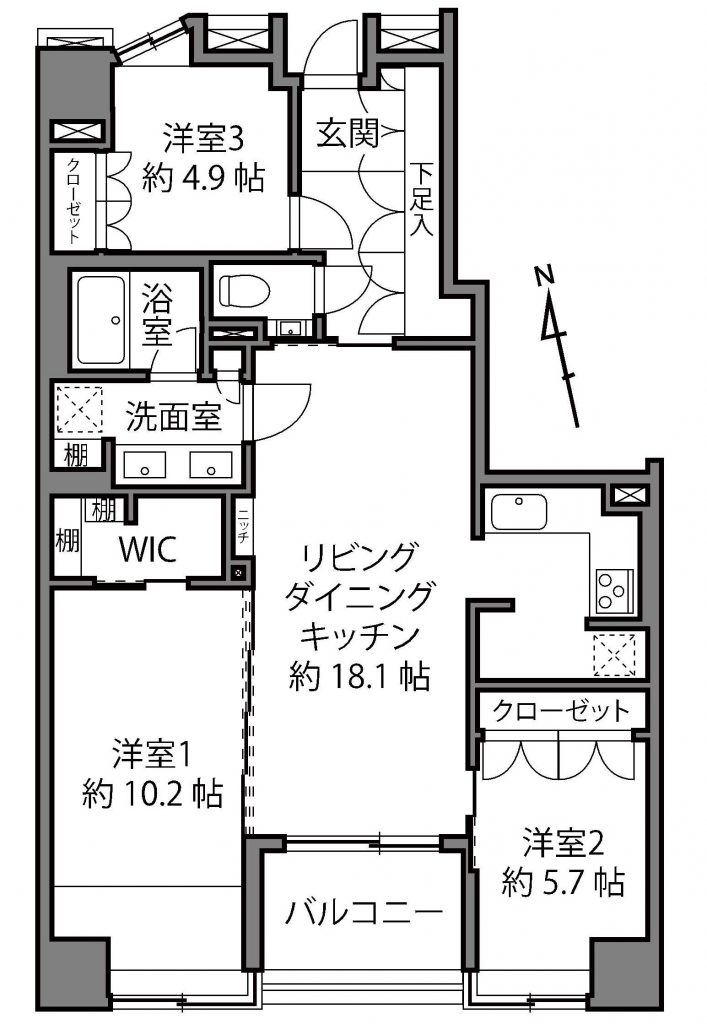

【アクシアフォレスタ麻布 6階】

東京メトロ南北線「麻布十番」駅 徒歩3分

都営地下鉄大江戸線「麻布十番」駅 徒歩3分

都営地下鉄大江戸線「赤羽橋」駅 徒歩15分~麻布十番の土地にマッチした「和洋折衷」をコンセプトにプランニング~

■2000年3月築、SRC造地下1階付10階建!!

■ウォークインクローゼット付き3LDK!!

■大型犬飼育可能!!

■2路線利用可能!!物件概要

物件名 アクシアフォレスタ麻布

所在地 港区麻布十番2丁目 アクセス 東京メトロ南北線・都営地下鉄大江戸線「麻布十番」駅 徒歩3分 価格 23,800万円 間取り 3LDK+1WIC 面積(平米) 専有面積:87.71㎡ バルコニー:6.41㎡ アルコープ:1.00㎡ 部屋向き 南 土地権利 所有権 建物構造 SRC造 地下1階付地上10階建 6階部分 築年 2000年3月 総戸数 95戸 管理費 21,930円/月 修繕積立金 21,930円/月 管理形態 全部委託(常駐) 駐車場 設置有 現況 空室 引渡時期 即可 取引形態 仲介 設備 ウォークインクローゼット/オートロック/床暖房/浴室乾燥機/独立洗面台/エレベーター/食洗器 備考 物件番号 06041401 物件更新日 2024/4/14 -

2024年4月14日

この物件のおすすめポイント

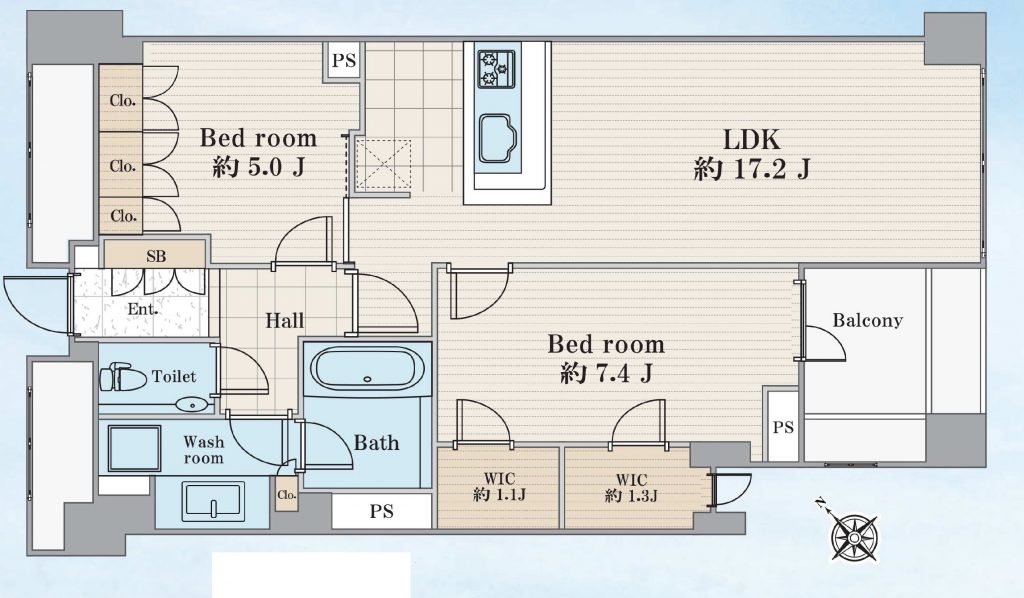

【オリエンタル千駄ヶ谷 1101号室】

JR山手線「代々木」駅 徒歩3分

都営地下鉄大江戸線「代々木」駅 徒歩5分

東京メトロ副都心線「北参道」駅 徒歩5分~最上階・ペントハウス・三方角部屋・二面バルコニー住戸~

■1983年7月築、SRC造11階建!!

■各居室に収納付きの2LDK!!

■新耐震基準!!

■複数駅・複数路線利用可能!!物件概要

物件名 オリエンタル千駄ヶ谷

所在地 渋谷区千駄ヶ谷5丁目 アクセス JR山手線・総武線「代々木」駅 徒歩3分 都営地下鉄大江戸線「代々木」駅徒歩5分 東京メトロ副都心「北参道」駅徒歩5分 価格 14,800万円 間取り 2LDK+WIC+DEN 面積(平米) 専有面積:84.22㎡ バルコニー:不明 部屋向き 南西 土地権利 所有権 建物構造 SRC造 地上11階建 11階部分 築年 1983年7月 総戸数 37戸 管理費 34,631円/月 修繕積立金 46,684円/月 管理形態 全部委託(巡回) 駐車場 無 現況 空室 引渡時期 即可 取引形態 仲介 設備 ウォークインクローゼット/オートロック/2面床暖房/浴室乾燥機/独立洗面台/エレベーター 備考 物件番号 06041402 物件更新日 2024/4/14 -

2024年4月14日

この物件のおすすめポイント

【宮益坂ビルディング ザ・渋谷レジデンス 810号室】

東京メトロ副都線・半蔵門線 東急東横線・田園都市線「渋谷」駅 徒歩1分

東京メトロ銀座線「渋谷」駅 徒歩2分

JR山手線・埼京線「渋谷」駅 徒歩3分~渋谷ヒカリエ隣接、ペデストリアンデッキで渋谷駅に直結~

■2020年7月築、RC造地下2階付き地上15階建!!

■角部屋の2LDK!!

■24時間有人管理!!

■ホテルライクな内廊下設計!!物件概要

物件名 宮益坂ビルディング ザ・渋谷レジデンス

所在地 渋谷区渋谷2丁目 アクセス 東京メトロ副都心線・半蔵門線 東急東横線・田園都市線「渋谷」駅 徒歩1分 東京メトロ銀座線「渋谷」駅徒歩2分 JR山手線・埼京線「渋谷」駅徒歩3分 価格 32,800万円 間取り 2LDK 面積(平米) 専有面積:58.01㎡ バルコニー:5.98㎡ 部屋向き 北 土地権利 所有権 建物構造 RC造 地下2階付地上15階建 8階部分 築年 2020年7月 総戸数 161戸 管理費 28,950円/月 修繕積立金 7,830円/月 管理形態 全部委託(日勤) 駐車場 有(月額43,000円~月額50,000円)※空要確認 現況 空室 引渡時期 相談 取引形態 仲介 設備 各階ゴミステーション/オートロック/床暖房/浴室乾燥機/独立洗面台/エレベーター 備考 物件番号 06041403 物件更新日 2024/4/14 -

2024年3月9日

この物件のおすすめポイント

【プレミスト赤坂檜町公園 402号室】

東京メトロ千代田線「赤坂」駅 徒歩7分

東京メトロ千代田線「乃木坂」駅 徒歩6分

東京メトロ日比谷線「六本木」駅 徒歩9分~港区赤坂7丁目の高台に佇む高級分譲マンション~

■2013年3月築、RC造地下2階付7階建!!

■収納豊富な2LDK!!

■東京ミッドタウンまで徒歩5分!!

■令和6年3月中旬リフォーム完成予定!!物件概要

物件名 プレミスト赤坂檜町公園

所在地 港区赤坂7丁目 アクセス 東京メトロ千代田線「乃木坂」駅 徒歩6分 価格 20,980万円 間取り 2LDK+2WIC 面積(平米) 専有面積:70.93㎡ バルコニー:6.91㎡ 部屋向き 南東 土地権利 所有権 建物構造 RC造 地下2階付地上7階建 4階部分 築年 2013年3月 総戸数 75戸 管理費 28,800円/月 修繕積立金 7,090円/月 管理形態 全部委託(常駐) 駐車場 空無 現況 空室 引渡時期 相談 取引形態 仲介 設備 ウォークインクローゼット/オートロック/宅配ボックス/浴室換気乾燥機/独立洗面台 備考 物件番号 06030901 物件更新日 2024/3/9 -

2024年3月9日

この物件のおすすめポイント

【パークタワー品川ベイワード 3209号室】

JR山手線・りんかい線「品川」駅 徒歩14分

~制震構造タワーマンションの最上階~

■2005年11月築、RC造32階建!!

■専有面積83.76㎡の3LDK!!

■20㎡のバルコニー付き!

■最上階・東南向きで陽当たり・眺望良好!!

■晴れた日にはレインボーブリッジ・スカイツリーなどを一望できます!!物件概要

物件名 パークタワー品川ベイワード

所在地 港区港南3丁目 アクセス JR山手線「品川」駅 徒歩14分 価格 18,000万円 間取り 3LDK+WIC 面積(平米) 専有面積:85.76㎡ バルコニー:20,0㎡ 部屋向き 東南 土地権利 所有権 建物構造 RC造 地上32階建 32階部分 築年 2005年11月 総戸数 326戸 管理費 24,610円/月 修繕積立金 9,430円/月 管理形態 全部委託(日勤)※夜間警備員対応 駐車場 空無 現況 空室 引渡時期 即日可 取引形態 仲介 設備 ウォークインクローゼット/ダブルオートロック/床暖房/ペット可(細則あり)/照明付き/食洗器/システムキッチン/宅配ボックス/浴室換気乾燥機/独立洗面台 備考 物件番号 06030902 物件更新日 2024/3/9

東京都心エリアの不動産仲介